south carolina estate tax exemption 2021

The current Federal Estate Tax Exemption for 2021 is 117 million per individual. Income from South Carolina sources includes income or gain from.

Cummings Lockwood Llc What Will Happen To Estate Gift And Generation Skipping Transfer Tax Exemptions In 2021 And Beyond

Homestead Tax-Exemption Program is for homeowners who are age 65 or older andor totally disabled andor totally blind as of December 31 preceding the tax year of the exemption.

. Dependent exemption - as of tax year 2020 4260 can be deducted for each eligible dependent. In 2007 legislation was passed that completely exempts school operating taxes for all owner occupied legal residences that qualify under SC Code of Laws Section 12-43-220 c. The fiduciary of a nonresident estate or trust must file a South Carolina Fiduciary Income Tax return if the estate or trust had income or gain that came from South Carolina sources.

The benefit is known as homestead tax exemption and provides that the first 50000 of the fair market value of the dwelling place including mobile homes on leased land shall be exempt from municipal county school and special assessment real property taxes. For decedents dying in 2013 the figure was 5250000 and the 2014 figure is 5340000. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15 million which represents the tax due on a Connecticut estate of approximately 129 million.

Overall South Carolina tax structure. Real Estate taxation is a year in arrears meaning to be exempt for the current year you must be the owner of record and your effective date of disability must be on or before 1231 of the previous year. Federal exemption for deaths on or after January 1 2023.

In January 2013 Congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation. The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020. Eligible dependents are dependents claimed on your federal Income Tax return.

South Carolina dependent exemption A South Carolina dependent exemption is allowed for each eligible dependent including both qualifying children and qualifying relatives. To receive this exemption you must generally apply at your county auditors office by July 15 of the year in which it is to. Most property tax exemptions are found in South Carolina Code Section 12-37-220.

1 The first fifty seventy-five thousand dollars of the fair market value of the dwelling place of a person is exempt from county municipal school and special assessment real estate property taxes when the person. The Homestead Exemption is a complete exemption of taxes on the first 50000 in Fair Market Value of your Legal Residence for homeowners over age 65 totally and permanently disabled or legally blind. The program exempts up to 50000 of the value of the home including up to five contiguous acres of property.

Copy of your South Carolina vehicle s registration. Current Federal Estate Tax Exemption. I has been a resident of this State for at least one year and has reached the age of sixty-five years on or before December thirty-first.

W South Carolina Dependent Exemption see instructions. Starting in 2022 the exclusion amount will increase annually based on. 19 00 20 Other SC withholding attach 1099.

19 Nonresident sale of real estate. W 00 4 Total subtractions add line f through line w. SC Tax Structure State Deductions and Exemptions South Carolinas other major state deductions contribute to low tax burden June 2021 4 In addition to the standard deduction SC has other deductions and exemptions the largest of which are.

I has been a resident of this State for at least one year and has reached the age of sixty-five years on or before December thirty-first. Net capital gain deduction. The good news is that the vast majority of the states will not be subject to the tax.

Real or tangible personal property located within South Carolina. The tax rate on funds in excess of the exemption amount is 40. See the worksheet below.

As if income taxes and property taxes werent enough the IRS gets to tax your estate if it is large enough. The estate tax is often referred to as the death tax. Copy of your South Carolina drivers license or identification card.

We streamlined the property tax exemption application process to. 1 The first fifty one hundred thousand dollars of the fair market value of the dwelling place of a person is exempt from county municipal school and special assessment real estate property taxes when the person. See below for a chart of historical Federal estate tax exemption amounts and tax rates Future Changes Expected for the Federal Estate Tax Exemption.

A Individuals estates and trusts are allowed a deduction from South Carolina taxable income equal to forty-four percent of net capital gain recognized in this State during a taxable year except for the portion of the capital gain that was recognized from the sale of gold silver platinum bullion or any combination of this bullion for which the deduction equals one. Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption. Please be aware of the following items that are required for eligibility of the Special Assessment Ratio 4 both items are needed from you and your spouse.

2021 INDIVIDUAL INCOME TAX RETURN. It only impacts less than 1 of all the states in America.

Remote Work Tax Reform Improving Tax Mobility And Tax Modernization

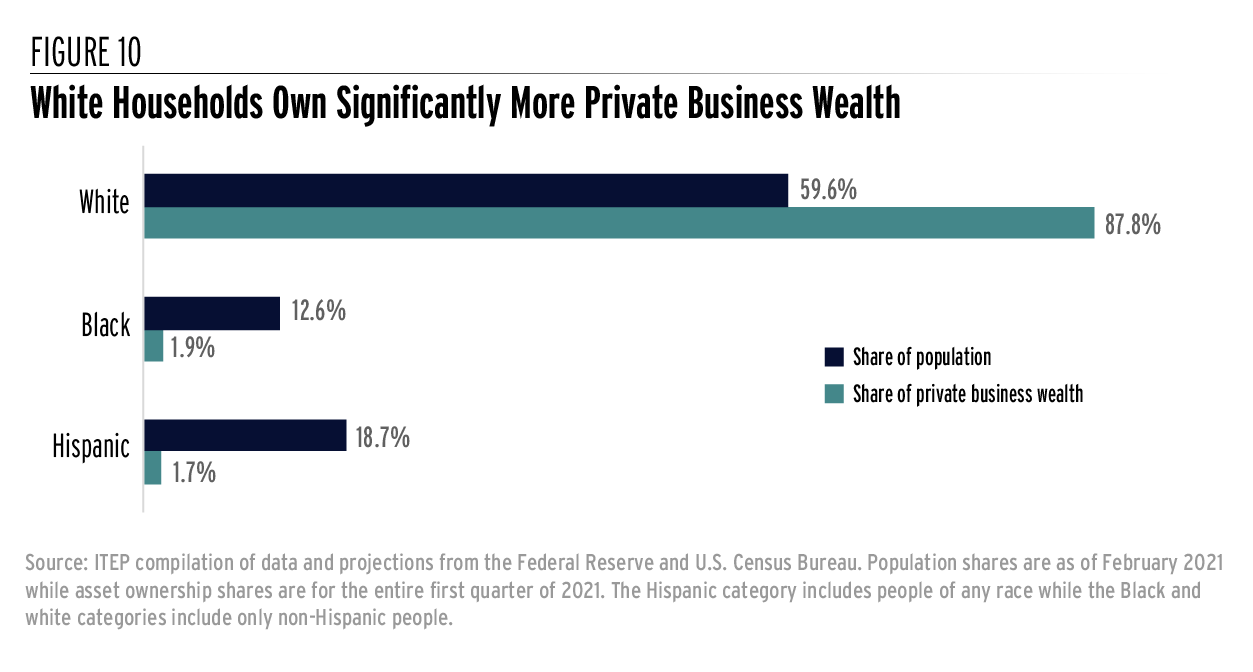

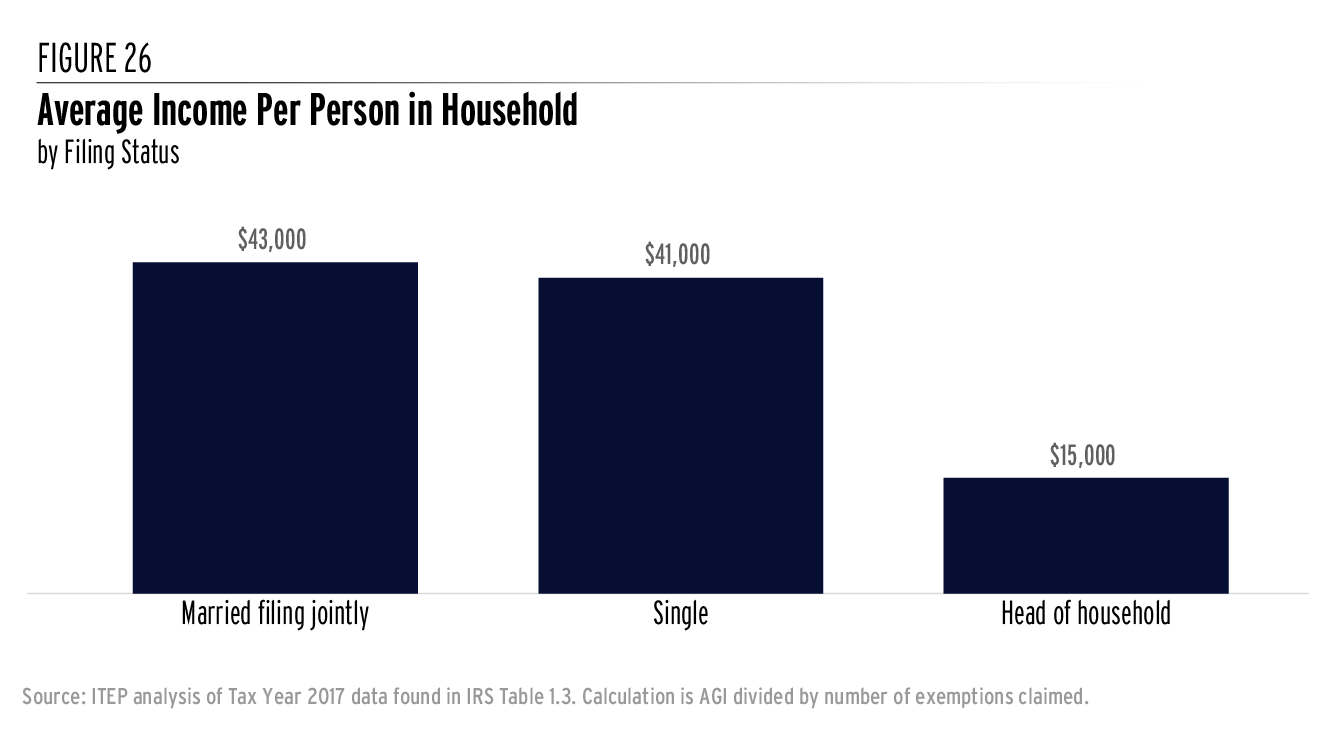

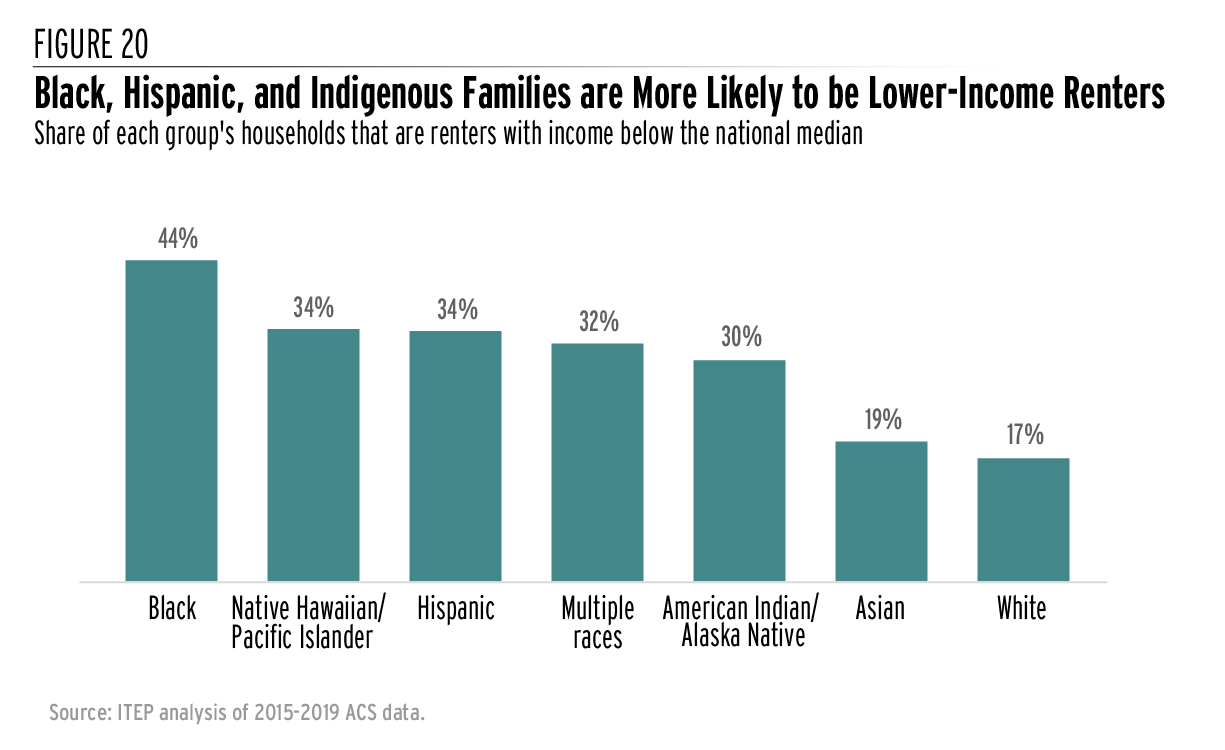

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Are Popular Estate And Gift Tax Planning Techniques Doomed 2021 Articles Resources Cla Cliftonlarsonallen

State Estate And Inheritance Taxes Itep

S C Introduces Card For Ag Sales Tax Exemptions Agriculture Thetandd Com

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

/182667184-56a636213df78cf7728bd987.jpg)

How Is Cost Basis Calculated On An Inherited Asset

The Lab Leak Theory Inside The Fight To Uncover Covid 19 S Origins Vanity Fair

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Historical South Carolina Tax Policy Information Ballotpedia