kern county property tax search

Establecer un Plan de Pagos. Ad Discover the Registered Owner Estimated Land Value Mortgage Information.

Notary Invoice Template Notary Public Business Notary Notary Signing Agent

Request For Escape Assessment Installment Plan.

. No CDs to load no concerns about dated information. Kern County real property taxes are due by 5 pm. Handled by the Assessors Office Application to Reapply Erroneous Tax Payment.

The Kern County Board of Supervisors met today as scheduled for Tuesdays April 26 2022 Board Meeting. Press enter or click to play code. Purchase a Birth Death or Marriage Certificate.

California Kern County 1655 Chester Ave Bakersfield CA 93301 Number. Alta Sierra Arvin Bakers Air Park Bakersfield 1 Bakersfield 2. KERN COUNTY ASSESSOR CHANGE OF ADDRESS FORM Please Type or Print Property valuation information and tax bills are mailed to the address contained in Assessors Office records.

Request a Value Review. This unclaimed money consists of Property Tax refunds where a warrantcheck was issued that remains uncashed for a period. Search property records in Kern County and lookup tax records available with the county recorder clerk.

Maps are in the TIFF image format. Please type the text from the image. 97 CENT STORE 11-347458.

Simply type in the exact address in the search box below and instantly run a quick property tax lookup. It is an honor and a privilege to have the opportunity to serve the taxpayers of Kern County. Kern County Assessment Rolls httpassessorcokerncausprop_searchphp Search Kern County property assessments by tax roll parcel number property owner address and taxable value.

Find Property Assessment Data Maps. Interested in a Kern County CA property tax search. Jordan Kaufman Treasurer-Tax Collector httpswwwkcttccokerncaus Mary B.

Assessors Parcel Map Search. Supervisor Phillip Peters District 1 Chairman Zack Scrivner District 2 Supervisor Mike Maggard District 3 Supervisor David Couch District 4 and Supervisor Leticia Perez District 5 were in attendance. Jump to a detailed profile search site with google or try advanced search.

Get Information on Supplemental Assessments. Here you will find answers to frequently asked questions and the most commonly requested property tax information. Enter one or more search terms.

We hope this information will be helpful to taxpayers in Kern County. Obtain a Recorded Document. You can enter the APN with or without dashes.

Property Assessor-Recorder Kern County CA. To our web site. If you enter a valid APN and the map is not found email the Webmaster.

The various payment methods available include mailing a check cash or money order to the kcttc payment center po. Kern County CA property tax assessment. Kern County has one of the highest median property taxes in the United States and is ranked 606th of the 3143 counties in order of median property taxes.

Kern County Assessment Rolls httpassessorcokerncausprop_searchphp Search Kern County property assessments by tax roll parcel number property owner address and taxable value. How to Use the Assessors Parcel Map Search. File an Assessment Appeal.

See Results in Minutes. Access tax information for any Kern County CA home. Change a Mailing Address.

99 CENT STORE 11-442988. The Kern County Auditor-Controllers Property Tax section is currently in possession of Unclaimed Property Tax Refunds generally resulting from roll corrections or cancellations. Application for Tax Relief for Military Personnel.

If you are having trouble viewingcompleting the forms you will need to download. 1401 19th Street Suite 200 Bakersfield CA 93301-4400. Kern County Assessors Website httpassessorcokerncaus Visit the Kern County Assessors website for contact information office hours tax payments and bills parcel and GIS.

Enter Any Address Receive a Comprehensive Property Report. Our mission is to collect manage and safeguard public funds to provide community services to the constituents of Kern County and we strive to do this in the most efficient and effective manner possible. Search and pay for your Kern County California property tax bill with this service.

Search for Uncashed Property Tax Refund WarrantsChecks. Property Search Options. File an Exemption or Exclusion.

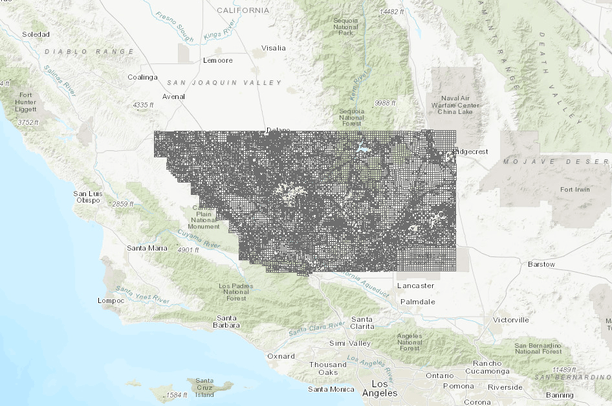

15 rows 24 ASSET MANAGEMENT 17-439793. Access vital information from any internet connection with one easy-to-use interface. Kern County Assessor-Recorder Assessor Maps Index.

The lien date for the assessment of property on the assessment roll is 1201 AM on January 1 of each year. Click Advanced for more search options. Connect from the office home road or around the world.

Our online access to Kern County public records data is the most convenient way to look up Tax Assessor data property characteristics deeds permits fictitious business names and more. Search for Recorded Documents or Maps. Kern County Assessors Website httpassessorcokerncaus Visit the Kern County Assessors website for contact information office hours tax payments and bills parcel and GIS.

Pay Transfer Tax on an Unrecorded Change in Ownership. Find out how to access property assessor lien and deed records. You can search for tax bills using either the Assessor Tax Number.

Application for Tax Penalty Relief.

Kern County Ca Property Tax Search And Records Propertyshark

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kentucky Fannie Mae Homepath Renovation Loans Credit Score Requirements Fannie Mae Renovation Loans Home Renovation Loan

Kern County Ca Property Tax Search And Records Propertyshark

Kern County Ca Property Tax Search And Records Propertyshark

Kern County Treasurer And Tax Collector

About The Grand Jury Kern County Ca

California Public Records Public Records California Public

Kern County Treasurer And Tax Collector

Pin On State Of California Sample Apostille

Kern County Ca Property Tax Search And Records Propertyshark

About The Grand Jury Kern County Ca